Quantopian Best Algorithms - Crowdsourcing has yielded impressive results in a variety of domains but investment management turned out not to be one of them. A Quantopian Alternative that for those new to coding and financeLearn to run your own trading accounts and not just join trading contests.

How My Machine Learning Trading Algorithm Outperformed The Sp500 For 10 Years By Tomiwa Towards Data Science

For Quantopian to hit the 70 million in revenues needed to be a 1 billion.

Quantopian best algorithms. You can use Quantopians data and development tools to develop your own investment algorithms. In conclusion my number one recommendation for people just getting into algorithmic trading is QuantConnect. Quantopian is a free online platform and community for education and creation of investment algorithms.

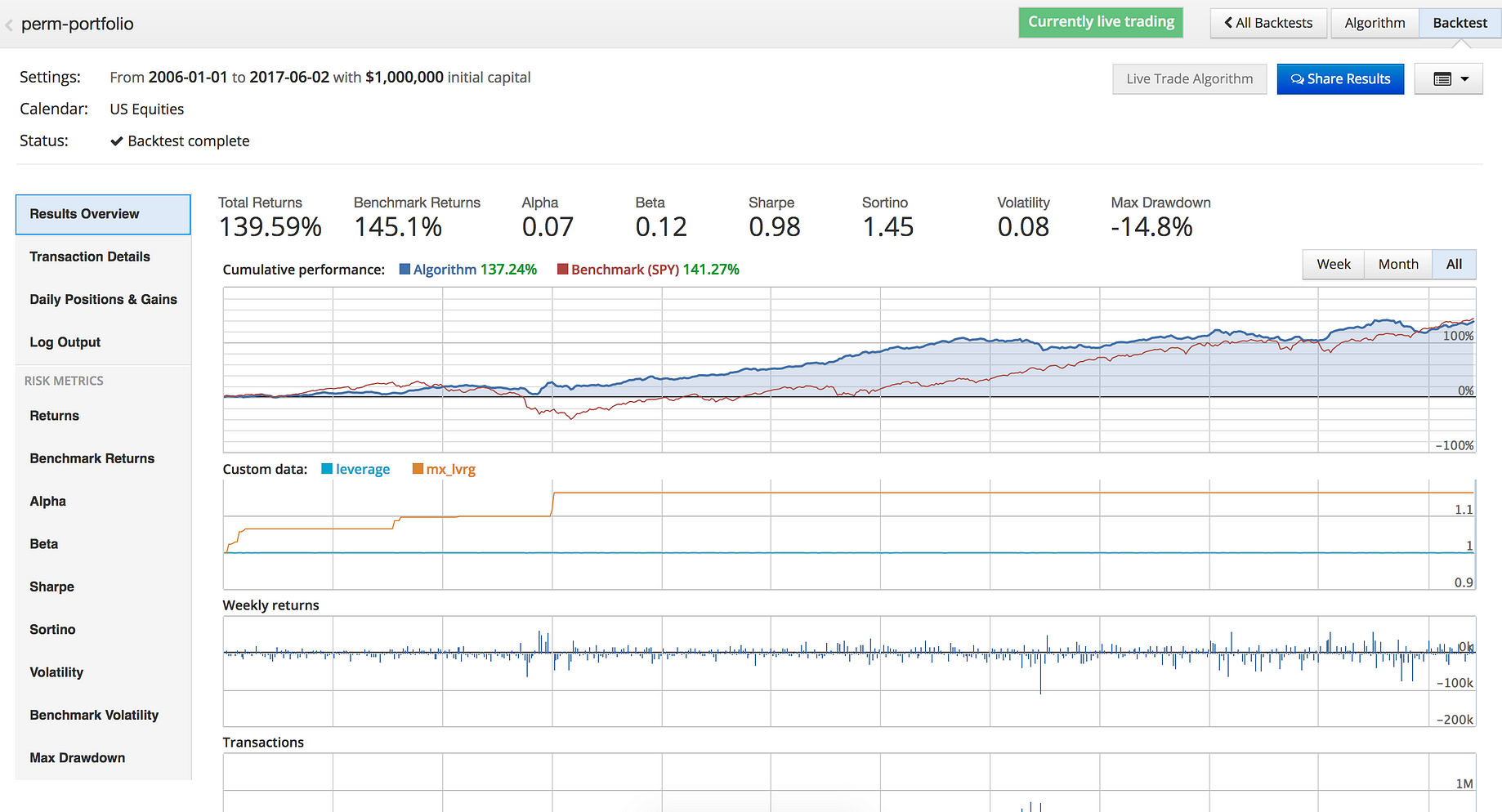

I hope this article gave you a good overview of some of the best algorithmic trading platforms. Additionally Quantopian allows users to run their newly designed algorithms through back-testing systems to determine the quality of their strategy and refine as needed. Quantopian is a US-based company where people can collaborate learn develop test and share their trading algorithms and backtesting results.

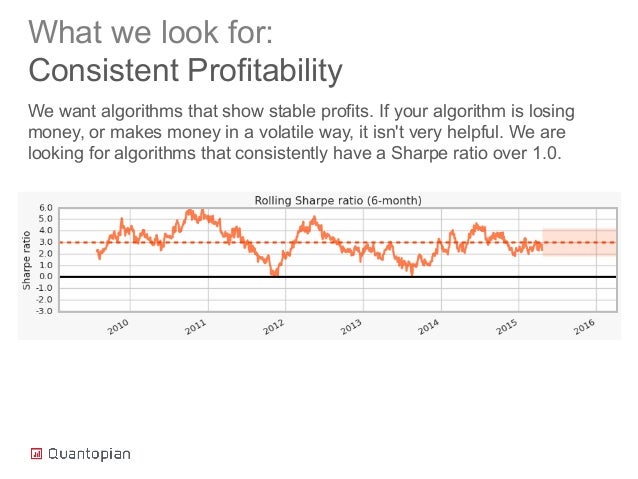

Quantopians founding idea was to apply the concept of crowdsourcing to investment management. When testing algorithms users have the option of a quick backtest or a larger full backtest and are provided the visual of portfolio performance. Our DLPAL LS customers can generate the strategy signals but the algorithm that achieves that is proprietary.

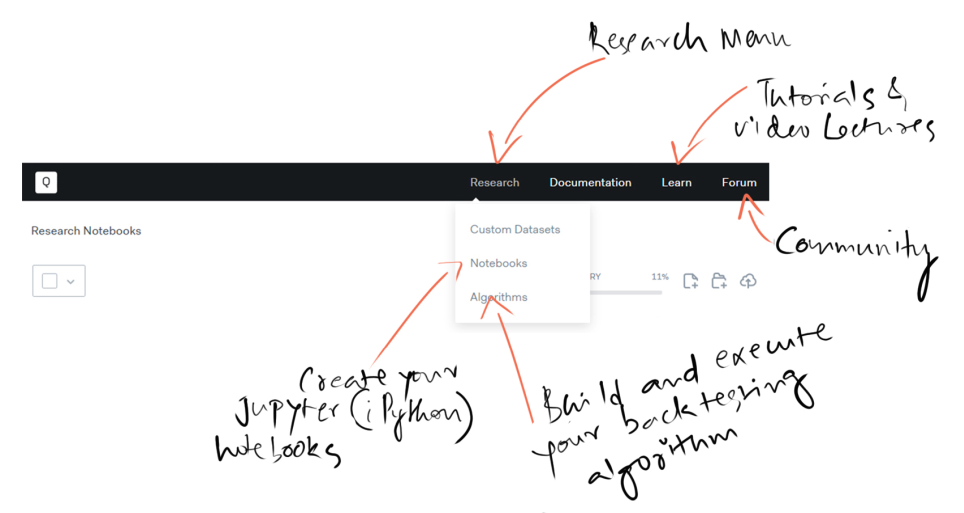

Though you might get jobs indirectly by becoming a good trader. Import quantopianalgorithm as algofrom quantopianpipeline import Pipelinefrom quantopianpipelinedatabuiltin import USEquityPricingfrom quantopianpipelinefilters import QTradableStocksUSfrom quantopianpipelinefiltersmorningstar import Q1500USfrom quantopianpipelinedatasentdex. Their platform is built with python and all algorithms are implemented in Python.

Here are my three takeaways from Quantopians announcement. This is a catch 22 of the algorithmic trading conundrum. To help gain a much better understanding of quantitative trading I want to give you an overview of all the different algorithmic trading strategies that exi.

Then you can access TradeStations instruments to carry out your investment strategy. The main issue is that we would never reveal the way the strategy operates to anyone included Quantopian. As you get more competition from other operators then you will have to refine it.

Trusting the wrong people. Thanks all my bot is jut down there. They support the most asset classes have a great community behind them allow you to live trade and have tons of free data.

Essentially the less competition that you have from competing trading algorithms the greater your profitability. Lucas has been featured on Investopedia and is one of the most viewed writers on Algorithmic Trading on Quora. You cant crowdsource alpha.

Quantopian for Algorithmic Trading Quantopian is a US-based company where people can collaborate learn develop test and share their trading algorithms and backtesting results. Quantopian offers access to deep financial data powerful research capabilities university-level education tools a backtester and a daily contest with real money prizes. In order to implement this in Quantopian we would have to reveal the algorithm and we would never do that.

Quantopian provides its users with free education various quant tools and data so that anyone can. In addition to providing coding tools and data sources Quantopian offers an attractive compensation structure which allows for top algorithms to earn a share of the net profits from their code. Here is my bot.

Quantopian provides a convenient ipython notebook interface for research and a simple to use IDE for implementation and back-testing of strategies that automatically logs key performance metrics and compares your strategy against a benchmark. A Boston-based crowd-sourced hedge fund Quantopian provides an online IDE to backtest algorithms. The 10kChallengeTemplatepy is a slight modification constraints - constraintsoptMaxTurnover02 of the template algorithm based on an algorithm provided by Leo M that Thomas Wiecki posted Jan 24 2020 in blog post where the 10K Third-Party Challenge.

A rule of thumb is that entrepreneurs want to boost by a factor of 10 the value of their start-ups each time at bat. The Quantopian platform is designed to do for algorithmic trading what Heroku did to make Ruby on Rails faster and easier to build web applications. Design a Factor for a Large US Corporate Pension was announced.

That S Funny 0 Drawdown

Quantopian Zipline Trading Algorithm Parameter Optimization With Spearmint Bayesian Optimizer Part 4 Prokopyshen Com

This Trading Algorithm Landed Me In The Top 10 On Quantopian Econometrics Io

Quantopian Is A Free Online Platform For Education And Creation Of Investment Algorithms Selected Algorithms Get Ca Finance Machine Learning Investment Advice

Predicting Future Returns Of Trading Algorithms Bayesian Cone Quantopian Blog

Introduction To Algorithmic Trading With Quantopian

Macd Strategy Quantopian Results Of The Backtest

This Trading Algorithm Landed Me In The Top 10 On Quantopian Econometrics Io

Winning Quantopian Morningstar Data Fundamentals Algorithm Prokopyshen Com

Github Evankirkiles Quantopian Algorithms Trading Algorithms Produced On Quantopian

Quantopian Crowd Sourced Systematic Alpha

Quantitative Trading Part 2 Getting Started With Quantopian The Platform By Lars Nielsen Medium

Adrisse Vet Ninjatrader Es Slippage Quantopian How Can I Get The Orders In A Backtest

How To Learn Algorithmic Trading Fast And Easy Trade Options With Me